Submissions to the XRB closed on 25 October 2024. Submissions to the IPSASB closed on 29 November 2024.

Amendments to measurement requirements (IPSASB) - Phase II

|

We are seeking feedback on proposals which aim to achieve consistent measurement requirements for assets held to provide services, to promote relevant and faithful measurement information in financial reports. If these International Public Sector Accounting Standards Board (IPSASB) proposals are introduced in New Zealand, they may change measurement requirements for certain assets held by public benefit entities in Tiers 1 and 2. |

|

Important background information

IPSASB Measurement project - changes not currently reflected in PBE Standards

Proposals at a glance

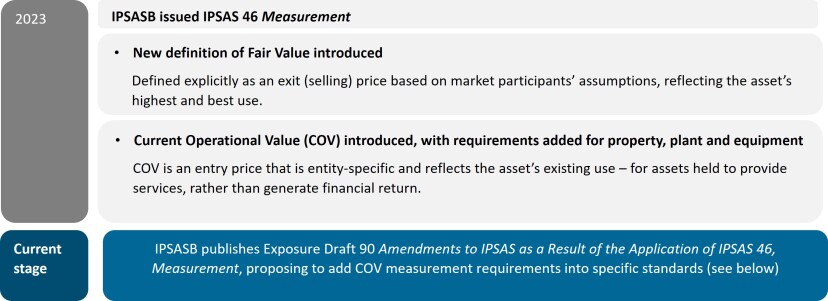

The proposals mainly relate to the new measurement basis ‘current operational value’ (COV), which the IPSASB introduced in 2023.

In issuing Exposure Draft 90, the IPSASB now proposes to add COV measurement requirements into certain existing standards – IPSAS 12 Inventories, IPSAS 31 Intangible Assets and IPSAS 21 Impairment of Non-Cash-Generating Assets. The aim is to enhance consistency between the measurement requirements across the suite of standards and achieve more relevant and faithful measurement of public sector inventories and intangible assets.

The IPSASB also proposes several clarifications around the application of the COV measurement basis, a new definition of ‘accounting estimates’, and streamlining disclosure requirements.

What this could mean in New Zealand

In New Zealand, PBE Standards for Tier 1 and Tier 2 public benefit entities (PBEs) in the public and not-for-profit sector are primarily based on IPSAS.

Currently, the COV measurement requirements introduced in IPSAS 46 are not included in PBE Standards in New Zealand. If COV is introduced into PBE Standards, the proposals in Exposure Draft 90 could change the existing measurement requirements for assets held by Tier 1 and Tier 2 PBEs. The key changes are summarised below.

|

IPSASB ED 90 proposals |

Current NZ requirements |

|

IPSASB 12 Inventories Inventory held for distribution at no cost or for a nominal cost to be measured at the lower of cost and COV. |

Under PBE IPSAS 12, such inventory is measured at cost adjusted for loss of service potential. |

|

IPSAS 31 Intangible Assets: For revalued intangible assets:

|

Under PBE IPSAS 31, revaluation of intangible assets is permitted only if there is an active market. Revaluations are performed using fair value measurement (per the old definition). |

|

IPSAS 21 Impairment of Non-Cash-Generating Assets When testing non-cash-generating asset for impairment, ‘recoverable service amount’ would be the higher of fair value (per the new IPSAS 46 definition) and COV. |

Under PBE IPSAS 21, ‘recoverable service amount’ is the higher of fair value (per the old definition) and ‘value in use’ (VIU, determined as depreciated replacement cost/restoration cost/service units). |

We want to hear from you

We are interested in your feedback on the Exposure Draft proposals. In particular, we are interested in hearing your perspective about the potential benefits of these proposed changes, as well as the potential cost impact (on aspects such as valuation model development, system changes, process alignment and staff education).

Your feedback will inform our submission to the IPSASB.

Please note: Once the IPSASB finalises the proposals in Exposure Draft 90, the XRB will look at the ‘package’ of the IPSASB’s measurement pronouncements and consider whether to include these in PBE Standards in New Zealand. We will consult separately on this at a later stage.

Thank you to everyone who provided feedback on this consultation. The New Zealand Accounting Standards Board considered the informal feedback received at as part of developing the Board's comment letter to the IPSASB.

The Board's comment letter to the IPSASB can be viewed below.

- Auditing and Assurance Standards open for consultation

-

Accounting Standards open for consultation

-

ED PBE IPSAS 47 Revenue

-

Amendments to XRB A2 resulting from the Regulatory Systems (Economic Development) Amendment Act 2025

-

Closed for comment

-

Closed for comment - Archive

-

Amendments to For-profit Domestic Accounting Standards due to NZ IFRS 18

-

Reporting and assurance of service performance information – Tier 1 and 2 not-for-profit entities

-

2025 Amendments to XRB A1 Application of the Accounting Standards Framework

-

ED PBE IPSAS 48 Transfer Expenses

-

Proposed new revenue and transfer expense accounting requirements for PBEs

-

Exploration for and Evaluation of Mineral Resources & Stripping Costs in the Production Phase of a Surface Mine

-

- Climate Standards open for consultation