NZASB Update 21/2020

IFRS IC Agenda decisions, November meeting, ED on borrowing costs

|

This NZASB Update provides you with an overview of the New Zealand Accounting Standards Board’s recent activities, any new standards or interpretations, as well as other matters of interest. |

|

|

Why not follow us on LinkedIn to catch up on our activities? |

The importance of IFRS Interpretations Committee Agenda decisions

|

|

Applies to: For-profit |

Did you know that the IFRS Interpretations Committee (Interpretations Committee) works together with the IASB in supporting the consistent application of IFRS Standards?

One way it does this is by issuing agenda decisions on application issues brought to their attention.

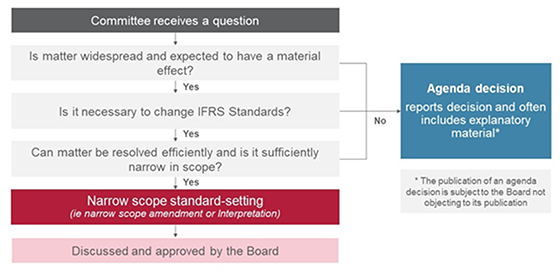

The process begins with a constituent submitting an issue. The Interpretations Committee applies criteria to decide whether a project should be added to its work plan.

If the Interpretations Committee decides that standard setting is not required to deal with a question received, it publishes an agenda decision explaining the reasons.

Agenda decisions often include explanatory material which explains how the applicable principles and requirements in IFRS Standards apply to the transaction or fact pattern described in the agenda decision. The objective of including explanatory material is to help support the consistency of application of IFRS Standards.

Although agenda decisions reflect existing requirements in Standards, they may provide new information (for example, by integrating requirements in the Standards with material in the Basis for Conclusions or Illustrative Examples). Consideration of the explanatory material in agenda decisions may lead an entity to change its accounting policies.

The IFRS Foundation has acknowledged that entities should have sufficient time to implement any changes in accounting policies that result from an agenda decision.

Tier 1 and Tier 2 for-profit entities when applying NZ IFRS should consider the explanatory material in agenda decisions when the fact pattern described in the agenda decision is relevant to a specific transaction, event, or condition being accounted for by the entity.

Accessing Interpretations Committee Agenda Decisions

You can search agenda decisions by standard:

We also have a link to these agenda decisions on our website:

Recent NZASB Meeting

4 November 2020 in Auckland

|

|

Applies to: Not-for-profitPublic Sector |

The NZASB meeting was a full day meeting.

You can access the public agenda, public meeting papers and read more about this meeting on our website.

- The Board discussed its draft comment letter on Business Combinations – Disclosures, Goodwill and Impairment.

- The Board discussed the revised PBE Policy Approach[1] and its application to recently approved IPSAS pronouncements:

- Public Sector Specific Financial Instruments – the Board requested that staff draft an Invitation to Comment and Exposure Draft (ED) from Amendments to IPSAS 41, Financial Instruments for a future meeting;

- COVID-19: Deferral of Effective Dates; the Board decided not to adopt this standard into PBE Standards.

- The Board approved the new amending standard PBE Interest Rate Benchmark Reform—Phase 2.

[1] Policy Approach to developing the Suite of PBE Standards, August 2020.

IPSASB ED – Guidance on borrowing costs

|

|

Applies to: Not-for-profitPublic Sector |

The IPSASB is seeking feedback on ED 74 IPSAS 5, Borrowing Costs – Non-authoritative Guidance (ED 74).

ED 74 proposes to add non-authoritative implementation guidance and illustrative examples to IPSAS 5. The proposals aim to clarify how the existing principles in IPSAS 5 on the capitalisation of borrowing costs should be applied in the public sector context. ED 74 does not propose to amend the authoritative material in IPSAS 5. The objective of the proposals is to address the practical challenges identified by constituents when capitalising borrowing costs that relate to qualifying assets.

We encourage you to read ED 74 and to comment on the proposals directly to the IPSASB as the NZASB will not be making a formal submission.

Please send your comments to IPSASB, with a copy to the NZASB, by 1 March 2021.

Have your say…

Before issuing a finalised accounting standard the NZASB and the international standard-setting boards, the IASB and the IPSASB, issue consultation documents. These documents seek your feedback on proposals that could potentially affect you.

We are currently consulting on the matters set out in the table below.

Tell us how these changes could affect your entity or the entities you work with.

We welcome your comments and feedback, either formal or informal, by the due dates below.

NZASB Consultation Document

Not-for-profitPublic Sector

|

Consultation Page |

Title |

Comments due to the NZASB |

|---|---|---|

|

Simple Format Reporting Standards – Post-implementation Review |

31 Mar 2021 |

* Request for Information

IASB Consultation Document

For-profit

|

Consultation Page |

Title |

Comments due to the NZASB |

Comments due to the IASB DP/2020/1 |

|---|---|---|---|

|

Business Combinations— Disclosures, Goodwill and Impairment |

Closed |

31 Dec 2020 |

IPSASB Consultation Document

Not-for-profitPublic Sector

|

Consultation Page |

Title |

Comments due to the NZASB |

Comments due to the IPSASB |

|---|---|---|---|

| ED 74 |

IPSAS 5, Borrowing Costs - Non-authoritative Guidance |

N/A |

1 Mar 2021 |

|

This NZASB Update is intended to provide subscribers with a summary of the recent activities of the New Zealand Accounting Standards Board (NZASB). Links to websites are correct at the time of publication. Subscribers should not rely on this newsletter as a definitive publication of updates. The External Reporting Board and its sub-Board the NZASB do not guarantee, and accept no legal liability whatsoever arising from or connected to, the accuracy, reliability, currency, timeliness or completeness of this newsletter. The information contained in this newsletter does not constitute advice and should not be relied upon as such. This NZASB Update refers to the work of the International Accounting Standards Board (IASB) and the International Public Sector Accounting Standards Board (IPSASB) and uses registered trademarks of the IFRS Foundation (for example, IFRS® Standards, IFRIC® Interpretations and IASB® papers). |