NZASB Update 9/2021

Tomorrow's NZASB Meeting, IPSASB Measurement EDs out, IASB webinar and more...

|

This NZASB Update provides you with an overview of the New Zealand Accounting Standards Board’s recent activities, any new standards or interpretations, as well as other matters of interest. |

|

Why not follow us on LinkedIn to catch up on our activities? |

In this NZASB Update we feature the:

- Upcoming May NZASB meeting;

- IPSASB has issued four Exposure Drafts (EDs) on Measurement;

- IASB webinar on a new approach to disclosure requirements in IFRS Standards;

- New versions of NZ IFRS and PBE standards are now available on the website.

Upcoming NZASB Meeting

13 May 2021

|

|

Applies to: For-profitNot-for-profitPublic Sector |

The meeting will be a half-day virtual meeting.

You can access the public agenda, public meeting papers and register to attend this meeting on our website.

The Board in the public session will:

- Decide which questions to comment on in the four IPSASB measurement-related EDs;

- Consider and approve the comment letters on IPSASB ED 75 Leases and RFI Concessionary Leases and Other Arrangements Similar to Leases;

- Review submissions received on the Post-implementation Review (PIR) of the Tier 3 and Tier 4 Standards; and

- Consider the annual review of the application of the PBE Policy Approach.

Changes proposed for measurement of public sector assets and liabilities

|

Applies to: Public Sector |

The International Public Sector Accounting Standards Board ( IPSASB) has recently published four EDs that could change how assets and liabilities are measured in the public sector.

The EDs will be of particular interest if you currently revalue assets (such as land and buildings) or hold assets with restrictions over their use or sale.

For entities holding heritage or infrastructure assets, the proposed additional guidance will also be of interest.

The four EDs are:

- ED 76 Conceptual Framework Update: Chapter 7, Measurement of Assets and Liabilities in Financial Statements

- ED 77 Measurement

- ED 78 Property, Plant and Equipment

- ED 79 Non-current Assets Held for Sale and Discontinued Operations

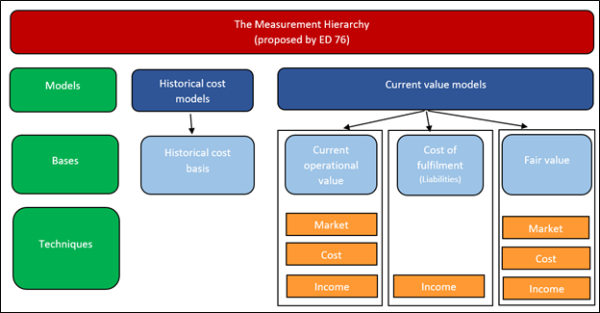

The EDs are based on a new measurement hierarchy, including a new measurement basis –current operational value – for revalued assets.

- ED 76 shows how the hierarchy would be reflected in Chapter 7 of the Conceptual Framework.

- ED 77 proposes a new standard explaining how to apply historical cost, current operational value, cost of fulfilment and fair value. The guidance on fair value is aligned with IFRS 13 Fair Value Measurement.

- ED 78 proposes a revised version of IPSAS 17 Property, Plant and Equipment showing how the proposals would affect revalued assets. It also proposes other changes such as more guidance on heritage and infrastructure assets.

- ED 79 proposes a new IPSAS based on IFRS 5 Non-current Assets Held for Sale and Discontinued Operations. This would fill a gap in IPSAS – there is no such gap in New Zealand’s PBE Standards.

A summary of each ED and how to provide your comments is published on our website.

Your comments are important because our PBE Standards for public sector and not-for-profit entities are based on standards issued by the IPSASB.

Comments to the NZASB close on 2 September 2021 and comments to the IPSASB close on 25 October 2021.

IASB Webinar on Disclosure Requirements in IFRS Standards—A Pilot Approach

|

|

Applies to: For-profit |

The International Accounting Standards Board (IASB) has developed a new approach to developing disclosure requirements in standards.

The new approach responds to concerns that the notes to the financial statements sometimes include too little relevant information, too much irrelevant information or ineffective communication.

The new approach is intended to help entities in making decisions about what information to disclose rather than using a ‘checklist’ or ‘boilerplate’ approach.

The IASB ED Disclosure Requirements in IFRS Standards—A Pilot Approach seeks feedback on the new approach and the application of new approach to the disclosure requirements in two standards – IAS 19 Employee Benefits and IFRS 13 Fair Value Measurement.

The IASB will be holding a series of webinars to discuss the proposals in the IASB ED.

The first, which will provide an overview of the proposals, will be held on Wednesday, 19 May 2021 at 8:00PM – 9:00PM NZT (9:00AM -10:00AM BST).

A recording of the webinar will be available after the event.

[link through to IFRS Foundation website]

For-profit and PBE Standards—new versions available

We have recently updated the versions of NZ IFRS and PBE Standards. All the new versions, incorporating consequential amendments from a number of new and amending standards, are now available on our website.

The most recent version of a standard is featured first on the landing page for that standard. Previous versions are listed below that.

We have made two short explanatory videos to give further explanation on why we provide new versions of our standards—just click the play button below to learn more now...

|

Why are there different versions of the same standard on a web page? |

|

Effective dates and early adoption explained |

Consultation papers open for comment

The following consultation papers are currently open for comment.

We welcome your comments and feedback, either formal or informal, by the due dates below. You can submit your comments directly from the consultation page on our website following the links below.

IASB Consultation Documents

For-profit

|

Consultation Page |

Title |

Comments due to the NZASB |

Comments due to the IASB |

|---|---|---|---|

|

Lack of Exchangeability (Proposed amendments to IAS 21) |

19 Jul 2021 |

1 Sep 2021 |

|

|

Third Agenda Consultation |

7 Jul 2021 |

27 Sep 2021 |

|

|

Disclosure Requirements in IFRS Standards – A Pilot Approach |

1 Sep 2021 |

21 Oct 2021 |

|

|

Regulatory Assets and Regulatory Liabilities |

Closed |

30 Jun 2021 |

|

|

Business Combinations under Common Control |

9 Jul 2021 |

1 Sep 2021 |

* Request for Information

IPSASB Consultation Documents

Not-for-profitPublic Sector

|

Consultation Page |

Title |

Comments due to the NZASB |

Comments due to the IPSASB |

|---|---|---|---|

|

Leases |

Closed |

17 May 2021 |

|

|

Concessionary Leases and Other Arrangements Similar to Leases |

Closed |

17 May 2021 |

|

|

Conceptual Framework Update: Chapter 7, Measurement of Assets and Liabilities in Financial Statements |

2 Sep 2021 |

25 Oct 2021 |

|

|

Measurement |

> 2 Sep 2021 |

25 Oct 2021 |

|

|

Property, Plant and Equipment |

2 Sep 2021 |

25 Oct 2021 |

|

| IPSASB ED 79 | Non-current Assets Held for Sale and Discontinued Operations | 2 Sep 2021 | 25 Oct 2021 |

|

NZASB Update is intended to provide subscribers with a summary of the recent activities of the New Zealand Accounting Standards Board (NZASB). Links to websites are correct at the time of publication. Subscribers should not rely on this newsletter as a definitive publication of updates. The External Reporting Board and its sub-Board the NZASB do not guarantee, and accept no legal liability whatsoever arising from or connected to, the accuracy, reliability, currency, timeliness or completeness of this newsletter. The information contained in this newsletter does not constitute advice and should not be relied upon as such. NZASB Update refers to the work of the International Accounting Standards Board (IASB) and the International Public Sector Accounting Standards Board (IPSASB) and uses registered trademarks of the IFRS Foundation (for example, IFRS® Standards, IFRIC® Interpretations and IASB® papers). |