Applying PBE IPSAS 41 Financial Instruments – FAQs

For Tier 1 and Tier 2 PBEs with non-complex financial instruments

November 2021

A helpful guide for Public Benefit Entities applying PBE IPSAS 41

|

PBE IPSAS 41 Financial Instruments is effective for accounting periods beginning on or after 1 January 2022. This PBE Standard establishes new requirements for the recognition, measurement, presentation, and disclosure of financial assets and financial liabilities.

The fact sheet and FAQs below explain the key changes in the new standard and how to apply them.

|

These FAQs have been developed by XRB staff to help Public Benefit Entities (PBEs) with non-complex financial instruments apply PBE IPSAS 41. Non-complex financial instruments include financial assets such as receivables, payables, term deposits and some investments in publicly traded shares. The guidance will be particularly useful for PBEs that have been applying PBE IPSAS 29 Financial Instruments: Recognition and Measurement and now have to apply PBE IPSAS 41.

We hope you find this document useful as a starting point. However, it should not be used as a substitute for reading the relevant requirements of PBE IPSAS 41, nor is it a substitute for professional accounting advice. We encourage you to discuss your transition to PBE IPSAS 41 with your accounting advisor – particularly if you hold complex financial instruments.

FAQs

PBE IPSAS 41 reflects the accounting requirements for financial instrument in current international standards. PBE IPSAS 29 was based on requirements that dated back to 2003. Since then international standard setters have simplified the classification and measurement of financial assets and developed a more forward-looking approach to calculating allowances for doubtful debts, with a view to reducing the risk of overstated assets.

PBE IPSAS 41 reflects these new requirements and is expected to result in higher-quality reporting on financial instruments.

PBE IPSAS 41 is closely aligned with the equivalent for-profit standard, NZ IFRS 9 Financial Instruments. This close alignment helps any PBEs that consolidate for-profit subsidiaries, as fewer consolidation adjustments are required.

The key changes introduced by PBE IPSAS 41 (as compared to PBE IPSAS 29) are summarised in the table below. In the sections that follow, we explain what these changes mean for an entity with relatively simple financial instruments.

|

Key changes |

Expected impact |

|

A new, simpler model for classifying and measuring financial assets |

You will have to reclassify financial assets using the new model. In some cases, this will lead to a change in what you call categories of financial assets in the notes. For example, instead of saying that your receivables are classified as ‘loans and receivables’, you would say that they are classified and measured at ‘amortised cost’. In some cases, you may also need to change how a financial asset is measured. |

|

A more forward-looking impairment model for financial assets |

The new impairment model requires a more forward-looking approach when calculating an allowance for doubtful debts. These allowances will need to reflect expected credit losses – which could mean recognising doubtful debts earlier. |

|

A new, less restrictive hedge accounting model (optional) |

If you use hedge accounting, you will have a choice. You can adopt the new hedge accounting requirements in PBE IPSAS 41, or continue using the old hedge accounting requirements in PBE IPSAS 29. The new requirements are less restrictive (for example, the 80%–125% hedge effectiveness rule is gone). |

|

Additional disclosures |

The impact of the new disclosure requirements will depend on the types of financial instruments held. Tier 2 disclosure concessions are available. |

|

Presentation changes for financial liabilities |

If you designate any financial liabilities as ‘fair value through surplus or deficit’ (which is uncommon for PBEs), there are new presentation requirements. Movements in fair value that relate to your own credit risk will be presented in other comprehensive revenue and expenses. |

The measurement, presentation, and disclosure requirements for financial instruments are based on the classification of the financial instrument (i.e. the classification of the financial instrument will determine how it should be accounted for).

The following table compares the new and old classification and measurement models for financial assets. Although some of the new categories are similar to the old ones, there are some differences, and you should classify all financial assets held in accordance with the new requirements

|

Old categories of financial assets |

New categories of financial assets |

|

(See question: How does amortised cost work?) |

|

|

|

|

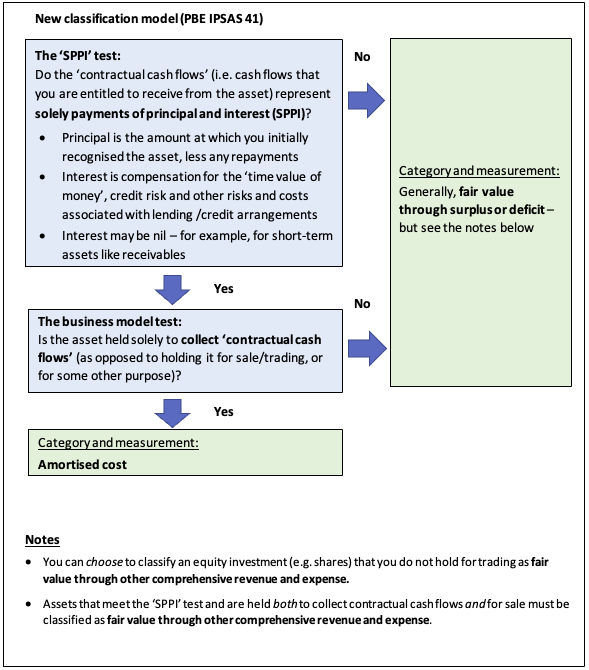

Under the old classification model, each category had its own set of rules for determining whether a financial asset should be classified in that category. Under the new model, classification and measurement is based on two key principles:

- The solely payments of principal and interest (SPPI) test; and

- The business model test.

(See the next question for further discussion).

The following diagram summarises the two key principles that govern the classification and measurement of financial assets under PBE IPSAS 41. It shows that amortised cost can be used only if the financial asset meets the ‘SPPI’ test and the business model test. Please note that this diagram summarises and simplifies the requirements.

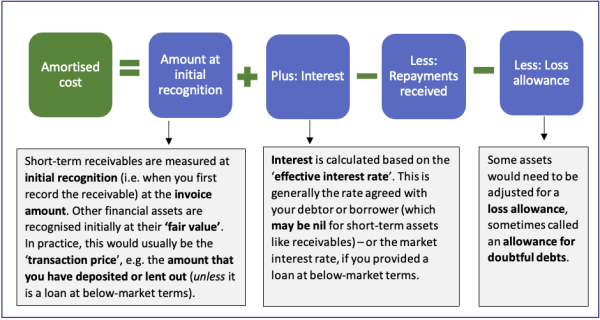

In simple terms, amortised cost is the initial amount of a financial asset adjusted by interest (if any), repayments and any allowance for doubtful debts.

For many short-term assets, such as receivables, the amortised cost would usually be the original transaction amount (e.g. the amount invoiced), reduced by an allowance for doubtful debts where necessary.

The full definition of amortised cost and the related requirements are set out in PBE IPSAS 41. See paragraphs 9, 61–70 and AG156–162 (and paragraphs 73 – 93 specifically in relation to impairment, i.e. the loss allowance/allowance for doubtful debts).

Generally speaking, ‘fair value’ is the amount for which you could sell an asset to an external party on market terms at a point in time. The full definition is “The amount for which an asset could be exchanged, or a liability settled, between knowledgeable, willing parties in an arm’s length transaction.”

When you hold financial assets for the purpose of making a profit on sale (rather than holding them to collect contractual cash flows), or when the cash flows that you are entitled to receive in relation to the asset are solely payments of principal and interest, PBE IPSAS 41 requires that these financial assets should be measured at fair value.

The related requirements for fair value measurement are set out in PBE IPSAS 41. See paragraphs 66–68, AG144–155.

The following table shows the likely classifications for common financial assets. More information on each type of asset is set out below the table.

|

Financial asset |

Likely classification under PBE IPSAS 41 |

|

Accounts receivables

|

Amortised cost Accounts receivables (such as trade debtors) will generally meet the criteria to be measured at amortised cost. Accounts receivable are likely to meet the solely payments of principal and interest (SPPI) test, because the cash flows you are entitled to receive are likely to be limited to the agreed receivable amount in exchange for the provision of goods or services (i.e. the principal amount – and interest is likely to be nil due to the short-term nature of the receivable). Trade debtors are also likely to meet the business model test (and therefore be measured at amortised cost), because your intention will be to collect the amounts specified in the invoice you have issued. |

|

Term deposits

|

Amortised cost Terms deposits will generally meet the criteria to be measured at amortised cost. In most cases, they would meet the solely payments of principal and interest (SPPI) test, because the cash flows you are entitled to receive will be the interest on the deposit and the return of the principal amount at the end of the deposit term. They are also likely to meet the business model test for being measured at amortised cost, because your intention will be to collect the specific cash flows that you are entitled to (i.e. the interest on the deposit and the principal amount at the end of the deposit term). Fixed interest bonds are also likely to be measured at amortised costs, unless you have a business model that includes an intention to sell the bonds before maturity. |

|

Investments in shares

|

Fair value through surplus or deficit, or fair value through other comprehensive revenue and expense Investments in shares and in unit funds will not generally meet the criteria for amortised cost. This is because the cash flows that you receive from these investments are not ‘solely payments of principal and interest’ (SPPI). Instead of receiving interest, you are likely to receive dividends – and rather than receiving the original amount invested, you will make a gain or a loss on your investment when you sell your shares or redeem your units, based on the market price at the time. Investments in shares will be measured at fair value through surplus or deficit – or, if you are not holding the shares to sell them for a short-term profit they can be measured at fair value through other comprehensive revenue and expense. |

|

Loans and advances to others |

In many cases, amortised cost The classification of loans and advances to others generally depends on whether they meet the SPPI test. For most loans, your intention would be to collect the payments that you are entitled to as per the loan agreement – meaning that the business model test for measurement at amortised cost would be met. In many cases, loans would also meet the SPPI test and will be measured at amortised cost. If they do not meet the SPPI test they will be measured at fair value through surplus or deficit (for example, this may be the case where under the terms of the loan, the borrower needs to repay the amount lent only if they achieve a certain level of earnings). We recommend that you discuss with your accounting adviser whether your loans and advances to others satisfy the ‘solely payments of principal and interest’ test.

|

This section relates to accounts receivable (trade debtors) arising from the provision of goods or services, fees receivable, grants receivable, and similar receivable balances. It does not cover loans and advances made by your organisation to others. Loans and advances are discussed in a separate section.

Generally, no. However, you will need to consider the new requirements for calculating the loss allowance, often called the allowance for doubtful debts (please see the next question).

PBE IPSAS 41 does not change the initial recognition of accounts receivable. Trade debtors and other receivables will continue to be recognised initially at the invoiced amount, or the amount you are entitled to receive under the relevant contract or agreement.

After initial recognition, most accounts receivable will still be measured at ‘amortised cost’, with an allowance for doubtful debts (see question: How does amortised cost work?).

Under the amortised cost method, the amount initially recognised increases as interest accrues and decreases as you receive payments from the debtor. Because accounts receivable are generally short term, the interest rate is likely to be zero. This means that in practice, accounts receivable will continue to be measured at the amount due from the debtor (the invoiced amount) – less an allowance for doubtful debts where applicable. When applying PBE IPSAS 41 you may need to change the way you calculate the allowance for doubtful debts. This is covered in the next question.

PBE IPSAS 41 takes a more forward-looking approach to ‘impairing’ trade debtors and other receivables, i.e. calculating the allowance for doubtful debts. It replaces the ‘incurred loss’ model in PBE IPSAS 29 with an ‘expected credit loss model’.

Under the expected credit loss model you may need to recognise an allowance for doubtful debts on your receivables earlier, and your allowance amount may increase. The next question discusses the expected credit loss model in more detail.

Although there are new requirements, the actual amount of the allowance for doubtful debts may not change much. This might be the case if you have a low receivables balance, or if you have very few debtors that fail to pay. Nevertheless, you will have check whether you need to change how you calculate allowances for doubtful debts in accordance with the new requirements.

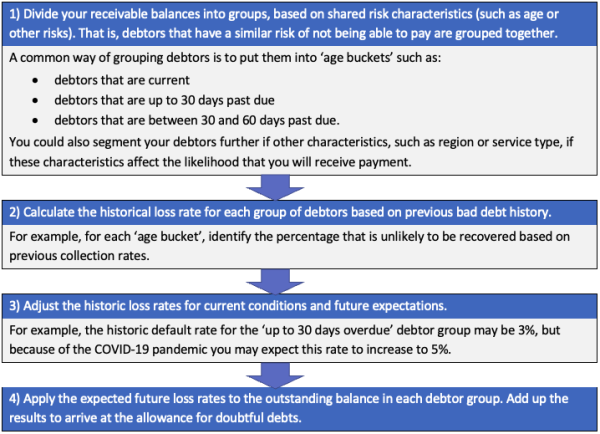

The new requirements are based on expected credit losses rather than incurred losses.

Under PBE IPSAS 29, the allowance for doubtful debts was based on incurred losses. An allowance for doubtful debts was recognised only once an event had occurred which indicated that a debtor may be unable to pay the amount receivable (e.g. your debtor gets into financial difficulties or misses the payment due date).

Under PBE IPSAS 41, the allowance for doubtful debts is based on expected credit losses. Under this approach, an allowance for doubtful debts is recognised based on possible future defaults and how likely they are to occur. This assessment is made without waiting for a specific event to occur.

Under this approach, an allowance for doubtful debts may need to be recognised even for receivable balances that are not yet ‘past due’ (but if it is highly likely that these debtors will pay, then the allowance for such debtors may be immaterial).

If an event occurs that indicates that a specific debtor will not be able to pay, then the expected amount that may be unrecoverable from this specific debtor is also factored into the allowance for doubtful debts calculation (i.e. the general allowance for doubtful debts is calculated after accounting for any specific doubtful debts).

When estimating expected credit losses for debtor balances under PBE IPSAS 41, you can base your expectations about future losses on past bad debt write-offs, but you may need to make adjustments to reflect expected future economic conditions, etc.

The allowance for doubtful debts can be calculated using a ‘provisioning matrix’. The provisioning matrix’ would be applied to the remaining population of accounts receivable after accounting for any specific doubtful debts. There are four steps in applying a provisioning matrix.

See paragraphs 87–89 and AG199 for more information on calculating the allowance for doubtful debts on receivables, using the ‘simplified approach’.

Example: Using a provisioning matrix to calculate the allowance for doubtful debts

A sports charity provides coaching services to a large number of small sports clubs and individuals. The charity charges a fee for these services. The charity is required to calculate an allowance for doubtful debts in relation to fees receivable at the reporting date in accordance with PBE IPSAS 41.

Generally, the longer fees have been past-due, the greater the risk that the fee will not be paid, and that the charity will have to write-off some or all the amount due. Therefore, the charity segments its fees receivable balance into ‘age buckets’. Based on data from previous years, which is adjusted for future expectations, the charity expects the following default rates in relation to fees receivable.

|

|

Age categories – fees receivable |

||||

|

|

Current |

Up to 30 days past due |

31–60 days past due |

61–90 days past due |

Over 90 days past due |

|

Expected loss rate |

0.5% |

1.5% |

2% |

3.5% |

10% |

The charity applies the expected default rates to the amount of fees receivable in each age category.

|

|

Expected loss rate |

Fees receivable balance |

Allowance for doubtful debts |

|

Current |

0.5% |

50,000 |

250 |

|

Up to 30 days past due |

1.5% |

20,000 |

300 |

|

31–60 days past due |

2.0% |

10,000 |

200 |

|

61–90 days past due |

3.5% |

8,000 |

280 |

|

Over 90 days past due |

10.0% |

5,000 |

500 |

|

Total |

|

93,000 |

1,530 |

If you are in Tier 1, you may need to provide additional disclosures about the credit risk in relation to your debtors (i.e. how you manage the risk that debtors may fail to pay), and on how you calculate the allowance for doubtful debts.

If you are in Tier 2, you do not need to provide these additional disclosures.

The new disclosures are set out in PBE IPSAS 30 Financial Instruments: Disclosures.

No.

PBE IPSAS 41 does not change the initial recognition of a term deposit. Generally, term deposits are initially recognised at the amount that you have deposited with the bank. After initial recognition, term deposits will generally continue to be measured at amortised cost – meaning that interest accrues on the deposit balance as earned.

Although PBE IPSAS 41 contains new impairment requirements, these would generally not have a significant impact on the measurement of term deposits held with a New Zealand bank or another reputable financial institution with a strong credit rating.

You will need to consider whether loans advanced to others that were previously measured at amortised cost can continue to be measured at amortised cost, or whether they need to be measured at fair value. It is expected that many loans advanced to others will continue to be measured at amortised cost. For loans that continue to be measured at amortised cost, you will still need to consider the new ‘impairment’ requirements for calculating the allowance for doubtful debts – which is based on expected credit losses. We recommend that you speak to your accounting advisor to confirm the accounting treatment under PBE IPSAS 41 for loans that you advance to others.

PBE IPSAS 41 does not change the initial recognition of loans advanced to others. If the terms of the loan are aligned with market terms, the loan is usually initially recognised at the amount lent. However, ‘concessionary loans’ with below-market terms

The accounting for loans advanced after initial recognition depends on whether they meet the criteria to be measured at amortised cost (see question: How do you classify and measure a financial asset under PBE IPSAS 41?). When making this assessment, the key judgement is likely to be around whether the cash flows from the loan are ‘solely payments of principal and interest’ (SPPI). Most basic loans are likely to pass the SPPI test, including many ‘basic’ interest-free and low-interest concessionary loans. Loans that pass the SPPI test would generally continue to be measured at amortised cost (see question: How does amortised cost work?). However, some loans could fail the SPPI test. This could be the case for loans with more complex repayment terms, including for some concessionary loans. For example, a loan where the borrower has to repay the principal amount only in certain circumstances (e.g. on reaching a certain level of earnings) may fail the SPPI test. Loans that fail the SPPI test are measured at fair value at the end of every year. If you have entered into any arrangements which include non-market terms, or arrangements that are different to a ‘basic’ lending arrangement, we recommend that you speak to your accounting advisor to confirm the accounting treatment under PBE IPSAS 41.

If the loans advanced meet the criteria to be measured at amortised cost, you will need to apply the new ‘expected credit loss’ model when assessing for any doubtful debts on loans and advances to others.

You cannot use the ‘simplified approach’ for receivables to calculate the allowance for doubtful debts on loans advanced. Estimating the provision for doubtful debts on loans and advances to others requires a few more steps than the ‘simplified approach’. It involves determining whether credit risk associated with the loan has increased significantly since the loan was initially recognised. For example, a significant increase in credit risk could happen if the borrower’s credit rating was or is expected to be downgraded, or there is an actual or expected significant negative change in the borrower’s operating results, or reduction in the financial support that the borrower receives from its parent entity, etc. If there was no significant increase in credit risk, then your doubtful debts allowance will reflect expected credit losses that are possible in the next 12 months. If credit risk increased significantly (or if an event occurred which indicates that the borrower may not be able to repay the loan – for example, if the borrower is in significant financial difficulty), then you will need to consider credit losses over the entire life of the loan. You can group loans together based on similar risk characteristics when assessing if credit risk increased significantly and when calculating expected credit losses. See paragraphs 73–83 in PBE IPSAS 41 for more information. Moving to the ‘expected credit loss’ model may lead to earlier recognition of doubtful debts in relation to loans advanced and may increase the size of the allowance for doubtful debts.

If you are in Tier 1, you will also need to provide additional disclosures about how you manage credit risk with respect to your loans, and how you calculated the allowance for doubtful debts. These disclosure requirements are set out in PBE IPSAS 30.

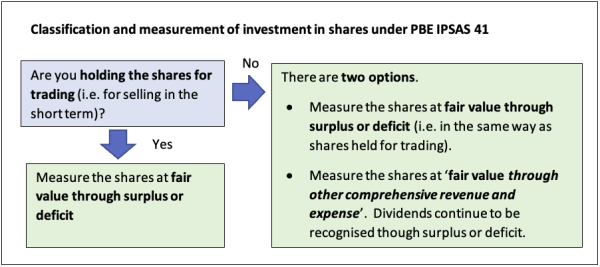

Under PBE IPSAS 41, shares are measured initially and at the end of each year at fair value, which is the price at which the shares would be sold between knowledgeable, willing parties in an arm’s length transaction (for example, the share price quoted on the stock exchange). This is similar to the old requirements in PBE IPSAS 29 (but see the next question, about the removal of the ‘cost exemption’ for unquoted shares).

Under PBE IPSAS 41, movements in the fair value of shares are recognised either in surplus or deficit, or in other comprehensive revenue and expense – depending on how you manage your investment.

For shares that are not held for trading (i.e. not for selling in the short term), you can choose to classify and measure the shares at fair value through other comprehensive revenue, instead of measuring them at fair value through surplus or deficit. The choice is available on a share-by-share basis. You need to make this decision when you initially recognise the shares, or when you apply PBE IPSAS 41 for the first time (i.e. you cannot switch from fair value through surplus or deficit to fair value through other comprehensive revenue and expense and vice versa from one year to the next).

No, unless cost is a reasonable estimate of fair value.

While PBE IPSAS 29 allowed unquoted shares to be measured at cost (instead of fair value), PBE IPSAS 41 does not have a similar exemption. To help with measuring the fair value of unquoted shares, PBE IPSAS 41 contains guidance on fair value measurement techniques in paragraphs AG149–AG155, and there are illustrative examples relating to unquoted shares in paragraphs IE178–IE 202.

Yes – for example, you will need to disclose which investments have been classified as fair value through other comprehensive revenue and expense, the fair value of material investments, and the dividends that you have received during the year from these investments.

Like shares, units in a fund would be measured at fair value under PBE IPSAS 41. If these units are held for trading, gains and losses are recognised in surplus or deficit. If the units are not held for trading, you might be able to classify the units as fair value through other comprehensive revenue and expense, but only if these units meet the definition of an ‘equity instrument’ (as per PBE IPSAS 28 Financial Instruments: Presentation). If they do not meet the definition of an equity instrument, then you will have to measure the units as ‘fair value through surplus or deficit’.

We recommend that you discuss the treatment of units in a fund with your accounting advisor.

It depends.

Under PBE IPSAS 41, you may need to account for your investment in bonds at amortised cost, or at fair value through surplus or deficit. The required treatment depends on whether you hold the bonds to collect the principal and interest amounts, or whether you hold them for trading or for some other purpose. It also depends on whether the payments that you are entitled to receive on the bond are ‘solely payments of principal and interest’.

We recommend that you discuss the accounting for bonds with your accounting advisor.

No – PBE IPSAS 41 does not change the accounting requirements for accounts payable (creditors).

Accounts payable will continue to be measured at ‘amortised cost’. In practice, this will be the amount that you need to pay as per the supplier invoice.

No. Loan liabilities will generally continue to be accounted in the same way as under the old requirements, i.e. at amortised cost. In practice, this will be the remaining principal of the loan, plus the accrued interest.

The requirements for concessionary loans, i.e. loans at below-market terms, are also similar to the old requirements. PBE IPSAS 41 includes guidance on concessionary loans and an example showing how a borrower accounts for a concessionary loan (see PBE IPSAS 41 paragraphs AG118–AG127 and Illustrative Example 20 at paragraphs IE153–IE155).

- Accounting Standards

- Auditing and Assurance Standards

- Climate Standards