Download the PDF version of this page here:

|

This guide highlights the ongoing requirements of NZ IFRS 16 and is designed to help you identify areas where further analysis may be needed. |

NZ IFRS 16 Leases introduced a fundamental change to lease accounting, bringing nearly all leases onto the balance sheet for Tier 1 and 2 for-profit lessees. Many entities invested significant resources when applying this standard for the first time.

It's important to remember that the accounting for leases using NZ IFRS 16 is not a 'set and forget’ process, rather there are many factors you need to consider at each reporting cycle. This guide highlights the ongoing requirements of NZ IFRS 16, some of the interplay with other Standards, and is intended to help you identify areas where you may need to undertake further analysis.

At each reporting period, you should consider whether there have been any changes to lease arrangements.

New leases

Reassessments of existing leases

Modification of leases

Termination of leases

|

Key on-going requirements |

Areas to consider |

| Have you identified all new leases? |

|

| Have any of your existing leases changed? |

|

| Have you considered impairment? |

|

| Have you determined the tax impact? |

|

| Have you captured all your required data for disclosures? |

|

| Have you entered into any sale and leaseback transactions |

|

Have you taken steps to identify all new leases entered into during the period, such as having a lease register, reviewing supplier contracts and checking 'at risk' expense codes and payments?

Once you have identified potential new leases do you have processes to assess whether a contract is, or contains, a lease?

Appendix 1

B31 of NZ IFRS 16

Remember to consider the contractual terms & conditions, relevant laws & regulations, and penalties* & termination rights.

*Penalties: should include the broader economies of the contract and not only contractual termination payments.

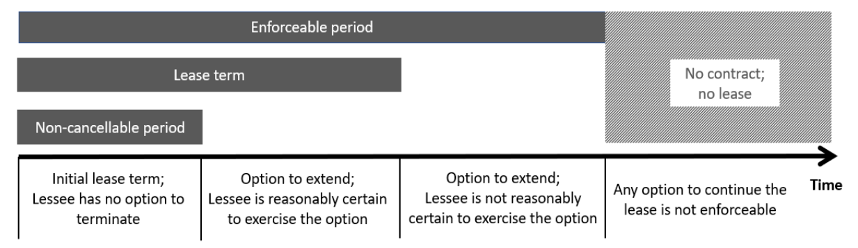

Diagram from: IFRS Interpretations Committee agenda paper 4, 26 – November 2019

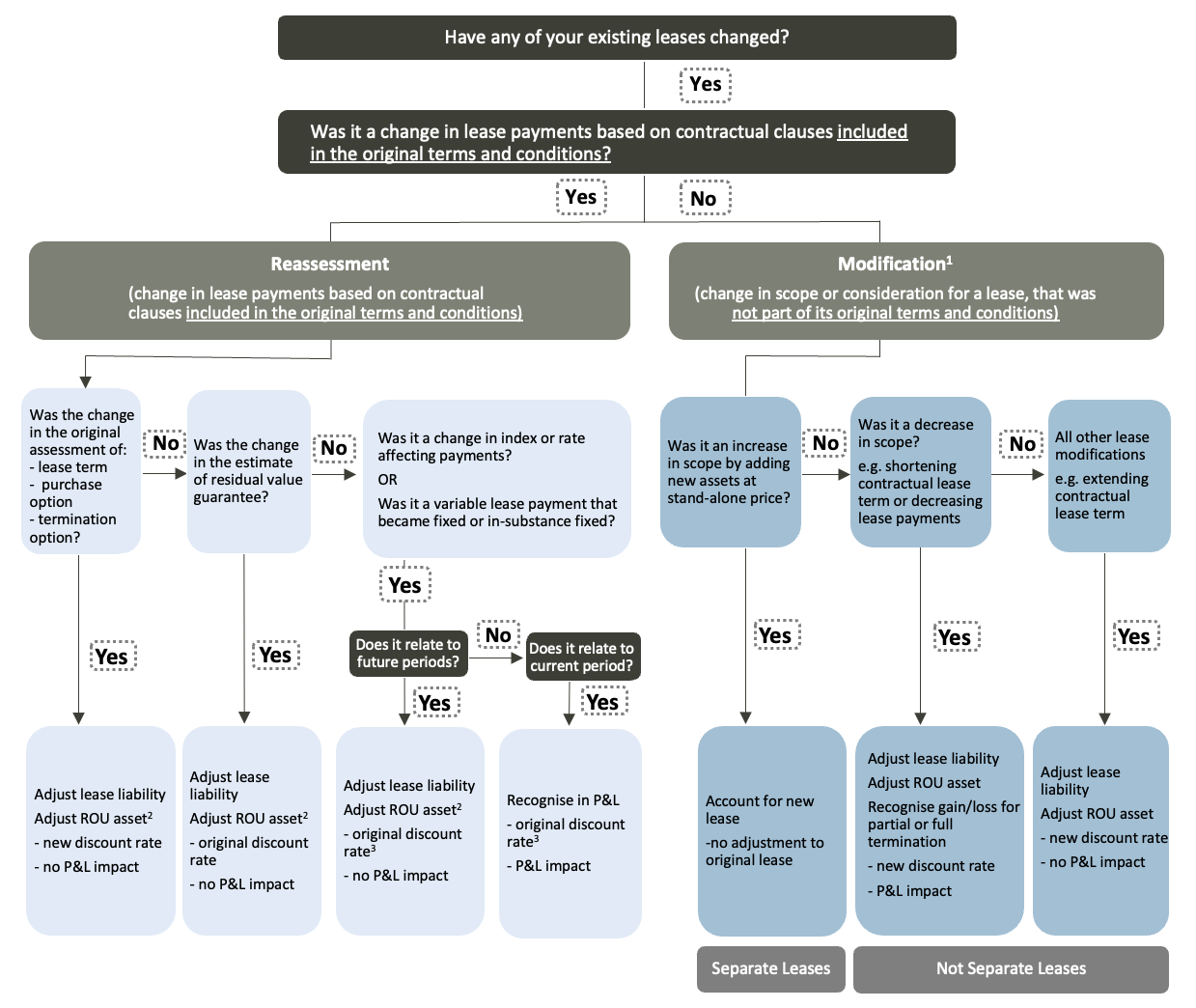

Accounting for reassessments and modifications can be complex and will depend on the circumstances of the underlying change.

1 Are you aware of the practical expedient for COVID-19 related rent concessions which permits lessees not to assess whether particular COVID-19-related rent concessions are lease modifications?

2 If the carrying amount of the ROU asset is reduced to zero, then any further reductions are recognised in profit or loss.

3 Unless the rate is a floating interest rate in which case revise the discount rate for the floating interest rate component.

Right of use (ROU) assets are often subsequently measured under a cost model. In some circumstances a fair value model under NZ IAS 40 Investment Property, or a revaluation model under NZ IAS 16 Property, Plant and Equipment may apply. ROU assets under a cost or revaluation model require consideration of impairment under NZ IAS 36 Impairment of Assets.

Have you applied the requirements in NZ IFRS 15 Revenue from Contracts with Customers to assess whether the seller-lessee has transferred control of the asset to the buyer-lessor? If control has not transferred (often referred to as a ‘failed sale’ ) the accounting treatment is significantly impacted.

Keep an eye out for a future guide which addresses sale and leaseback transactions in more detail.

Last Updated: